If you’re an Aucklander, you know the daily commute is more than just a routine—it’s a lifestyle factor. Whether you’re navigating the North Shore, dodging traffic on the Southern Motorway, or hopping off the train in Britomart, the big question remains: should you finance a car or stick to public transport?

With Auckland’s sprawling geography and evolving infrastructure, the decision isn’t always straightforward. Let’s unpack the costs, convenience, and lifestyle implications of both options—and how Auckland Loans can make car ownership more achievable.

The Case for Public Transport in Auckland

Auckland’s public transport system – which comprises buses, trains and ferries – sometimes gets a bad wrap. Whether it’s issues with the train network or problems with buses being late, Aucklanders are quick to point out that taking public transport in the city can be a bit of a nightmare. It even prompted a review into the system’s reliability by the Auditor-General!

Despite those complaints, there are some real benefits to using public transport. While coverage and frequency can vary, for many commuters—especially those working in the CBD—public transport can offer a predictable, if sometimes slower, alternative to driving.

Average Cost of Public Transport

Let’s break it down with just one example of a common commute within Auckland. For a commuter travelling from Te Atatū to the city (a 2-zone trip), you’d pay:

Adult fare (HOP card): $4.65 each way

Daily return trip: $9.30

Monthly (20 days): $172.00

If you go further, say from Papakura to the CBD (4 zones), you’re looking at $7.65 per trip.

AT’s 7-day fare cap scheme means as long as you use your HOP card, your fares are capped at $50 per week.

That’s a pretty tidy price when compared to the upfront and ongoing costs of car ownership!

Public transport also offers:

- Less hassle: No need to worry about petrol, WOFs, or parking meters.

- Environmental impact: Fewer emissions and congestion.

- No parking stress: If you’ve ever circled the city for 30 minutes, you know the value of this.

However, that’s not the whole picture—especially in a sprawling city like Auckland.

The Case for Car Ownership in Auckland

Auckland’s public transport leaves a lot to be desired, particularly outside peak hours or away from main routes. For many Aucklanders, a car isn’t a luxury—it’s a necessity. For those who need the freedom to go exactly where they want and when they want, a car really is a must-have.

Average Cost of Car Ownership

Here’s a ballpark breakdown of the costs of owning a modest used car in Auckland:

- Purchase price: $10,000 – $15,000 (or finance from $68/week*)

- Fuel: $3000/year ($60 per week, depending on how far you travel)

- Insurance: $1000/year ($20/week)

- Warrant of Fitness (WOF) & rego: $300/year

- Maintenance: $1000/year average

- Estimated weekly cost: $165/week

Sure, it’s more than the bus fare. But with Auckland Loans’ affordable car loans, you don’t have to pay that $10,000 up front. Borrowing $10,000 unsecured could cost as little as $68 a week over 48 months, leaving you with the freedom of four wheels, without the financial headache.

*Calculated using Auckland Loans’ online loan calculator. Based on a $10,000 loan over 48 months at 12.95%.

Comparing the Real Life Trade-Offs

| Feature | Public Transport | Car Ownership |

|---|---|---|

| Travel Time | Often longer due to transfers | Typically faster door-to-door |

| Flexibility | Fixed schedules and routes | Total freedom to travel anytime |

| Comfort | Crowded, especially at peak times | Personal space, climate control |

| Coverage | Best in city centre & major hubs | Access to remote or off-route areas |

| Convenience | No parking or car maintenance | Park anywhere, go anywhere |

Why Many Aucklanders Are Choosing to Finance a Car

Let’s face it—Auckland’s urban sprawl doesn’t make public transport the most convenient option for everyone. A 10-minute drive can become a 50-minute trip when you’re stuck with limited transport options, waiting on a bus that only runs every half hour, and walking the last 1.2km to your destination.

That’s where a car gives you the edge. Whether it’s:

- Doing the school run and heading straight to work

- Popping out to Westgate, Botany, or Sylvia Park on the weekend

- Driving to your night shift or heading out of town on a whim

Having your own vehicle just makes life easier! Auckland Loans is here to make that easier, too.

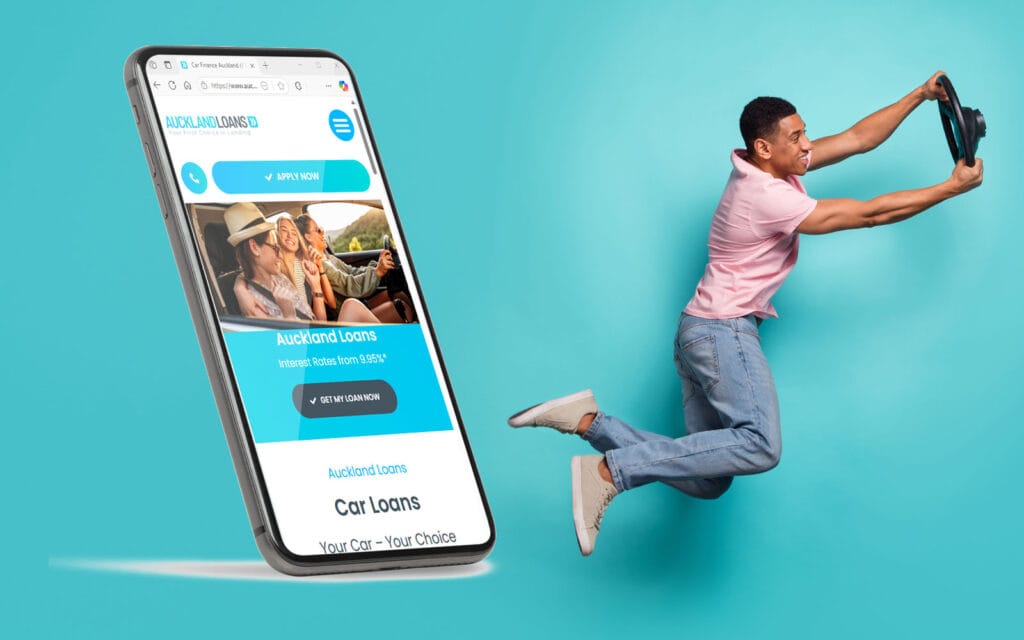

Affordable Car Finance With Auckland Loans

We get it—owning a car isn’t cheap, but it doesn’t have to be out of reach. At Auckland Loans, we specialise in affordable, flexible car finance Auckland-wide.

- Fast approvals within 1-2 hours* – Same-day decisions*

- Flexible terms – From 6 to 84 months

- Low rates – From just 11.95%

- Bad credit? – We help those with less-than-perfect scores too

With one quick 2-minute application, you can get multiple low-cost options from trusted lenders. It’s 100% online, with support from a friendly, local team that understands Auckland life and the roads you travel.

Ready to Roll?

Apply online in minutes and get a fast, free, no-obligation car loan quote from Auckland Loans. It feels good to get a great deal—and even better when it’s approved the same day*.

Whether it’s your first car, an upgrade, a switch to an electric vehicle, or a second vehicle for the household, we’ll help you make it happen.

*Subject to responsible lending checks and criteria.